Salesforce Stock Analysis: Technical Indicators Suggest a Potential Upside Move

$$248.22

Salesforce Stock Analysis: Technical Indicators Suggest a Potential Upside Move

16 Oct 2025, 13:05

SigmaRoc PLC (LON: "SRC") is a UK based minerals mining company which has greatly benefitted from the rise in the cost of natural minerals. The reason this share has become interesting is because the directors have repurchased shares back from the business in recent days/weeks.

From a financial aspect the company is pretty good. Total market cap is £625m with H1 2021 revenue at £84.7m and profit after tax of £5.9m. Given these numbers, forecasting the entirety of 2021, minipip would expect revenue at £186m with a profit after tax of £12.9m. Looking at the balance sheet, cash on hand was £19.9m with total assets at £265m. Liabilities came in at £136.9m leaving net positive £128.1m. Overall, good steady numbers.

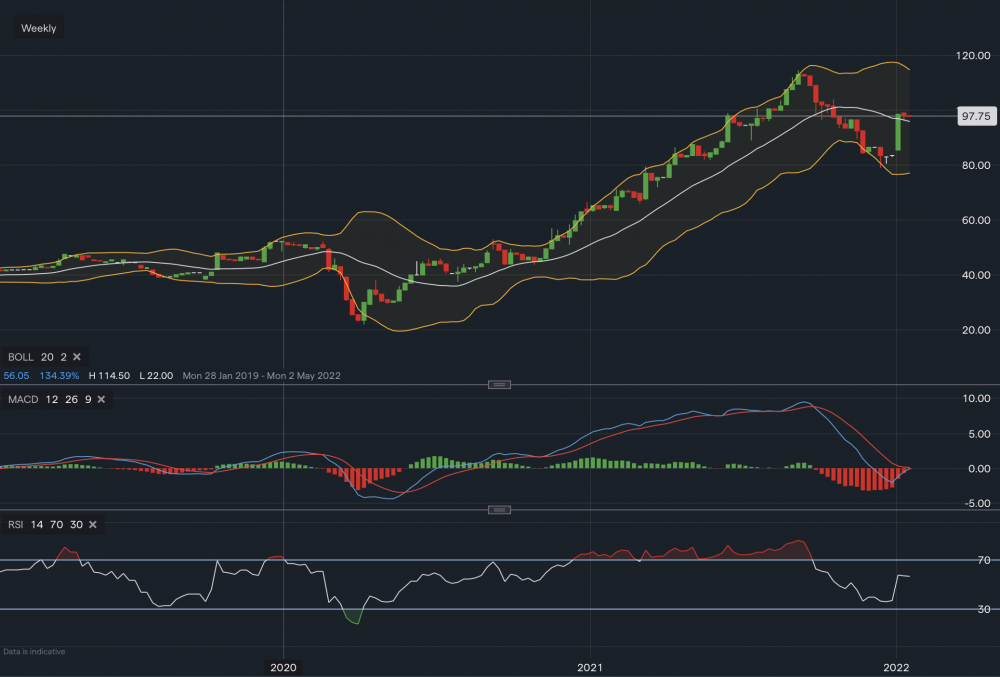

From a technical aspect the stock has also broken out of a downtrend dating back over 4 months. A steep rise of 15% at the start of the year now puts targets/resistance at £1.145 and then £1.20. Looking to the downside, support sits at 92p followed by 80p. A break below here could see the share head lower towards 60p region. MACD has turned positive, RSI is flat at 56 and the share trades in the upper Bollinger band on the weekly timeframe. All positive signs.

Overall this share looks good. It's in an industry which is curtail to supply chains across Europe, as a result, demand for their services and products should remain high therefore guidance for the company should be positive for 2022. With the directors buying back shares as well, this would perhaps indicate that they may go higher.