S&P 500 Analysis: Could the US500 Be Preparing for a Bullish Reversal?

$67.73

09 Mar 2026, 23:00

Opportunity costs are the benefits forgone of the next best alternative. The concept of opportunity cost was first developed by an Austrian economist, Wieser and other notable contributors including Daven Port, Knight, Wicksteed and Robbins. It is based on the fundamental fact that factors of production are scarce and versatile. An opportunity cost does not only include monetary costs, but it includes all real costs of making one choice over another, including the psychic profit of lost time, energy, and pleasure.

Economists use the concept of opportunity costs for several reasons including:

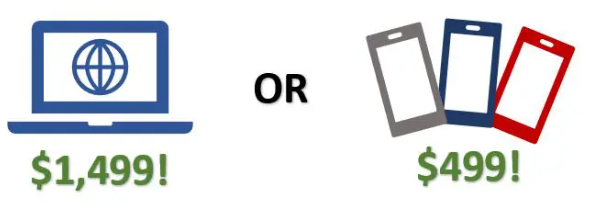

Determination of the prices of goods – Applying opportunity costs is useful in order to determine the relative prices of different goods. For example, if a given number of factors can produce one laptop or three phones, then the price of one laptop will tend to be three times equal to that of one phone.

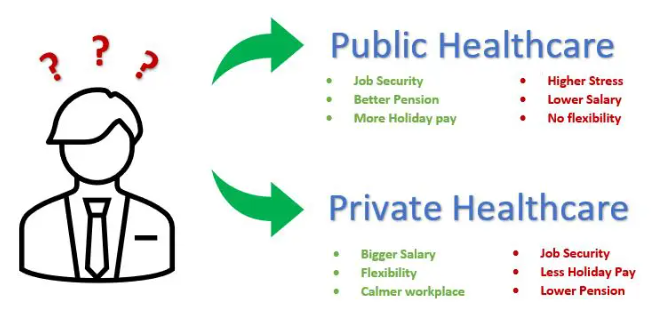

Fixation of Remuneration to a Factor – The concept is also useful in fixing the price of a factor. For instance, let us assume that the alternative employment of a teacher is to work as a tax advisor for a firm at a salary of £3,000 per month. In such a case, he must be paid at least £3,000 to continue working at the school as a teacher. Quite often this concept is seen in civil service & healthcare roles where individuals may leave government-funded institutions for private companies as pay and benefits are better, but the opportunity cost could be job security or pension.

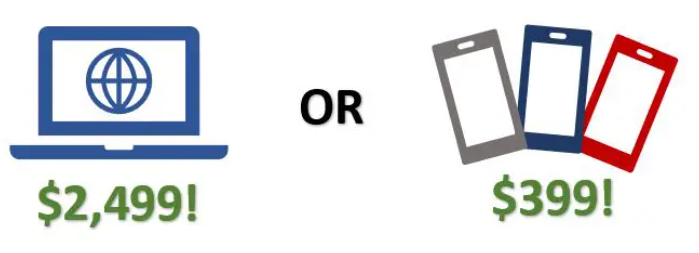

Efficient Allocation of Resources – The concept is also useful in allocating resources efficiently. Suppose, the opportunity cost of 1 laptop is 3 phones and the price of a phone is $100, while the price of a laptop is $400. Under such circumstances, it is beneficial to produce one laptop rather than 3 phones. Because, if the manufacturer produces 3 phones, he will get only $300, whereas a laptop gets the manufacturer $400, that is, $100 more.

Decision-makers are often quick to neglect the impact opportunity costs have when making choices. The consequences of decisions are often overestimated or underestimated. Not only are we subject to false and asymmetric information but also normative statements that prevent us from making informed and rational decisions. Subsequent consequences soon arise due to our uninformed decisions which can affect us both psychologically and monetarily. When opportunity costs are not taken it into consideration while making a choice, decision-making pitfalls occur. Rational people always apply the cost-benefit analysis to their decision-making process, that is an action can only be done on the condition that the extra benefit is greater than the extra cost, but the common problem amongst many of the decision-makers is that they neglect the implicit costs. However, taking forgone opportunities into account is vital for prudent and intelligent decision-making. The concept of opportunity cost is becoming increasingly important in society as more and more household incomes are becoming stretched to the limits. It is important to take opportunity cost into account in every kind of decision. It is not only important for the economist but also for the common rational person to take opportunity cost into account in order to increase their utility and to make better choices amongst scarce resources.

The concept of opportunity costs plays a heavy part when investing or trading as investors need to make conscious decisions and understand the risk to reward when buying a stock or placing a trade. Investors need to ask themselves if the opportunity costs of buying one stock over another are more beneficial and if the downside risk is also considered with the opportunity cost and risks associated.

some content is sourced from – Wikipedia

Tradable assets:

Spread Betting, CFDs, ISAs, Managed Portfolios, Share Dealing

Rating:

FCA: ![]()