General Dynamics (GD) Fundamental and Technical Stock Analysis: Can the Defence Prime Keep Outperforming?

$364.70

04 Mar 2026, 12:54

Unsplash.com

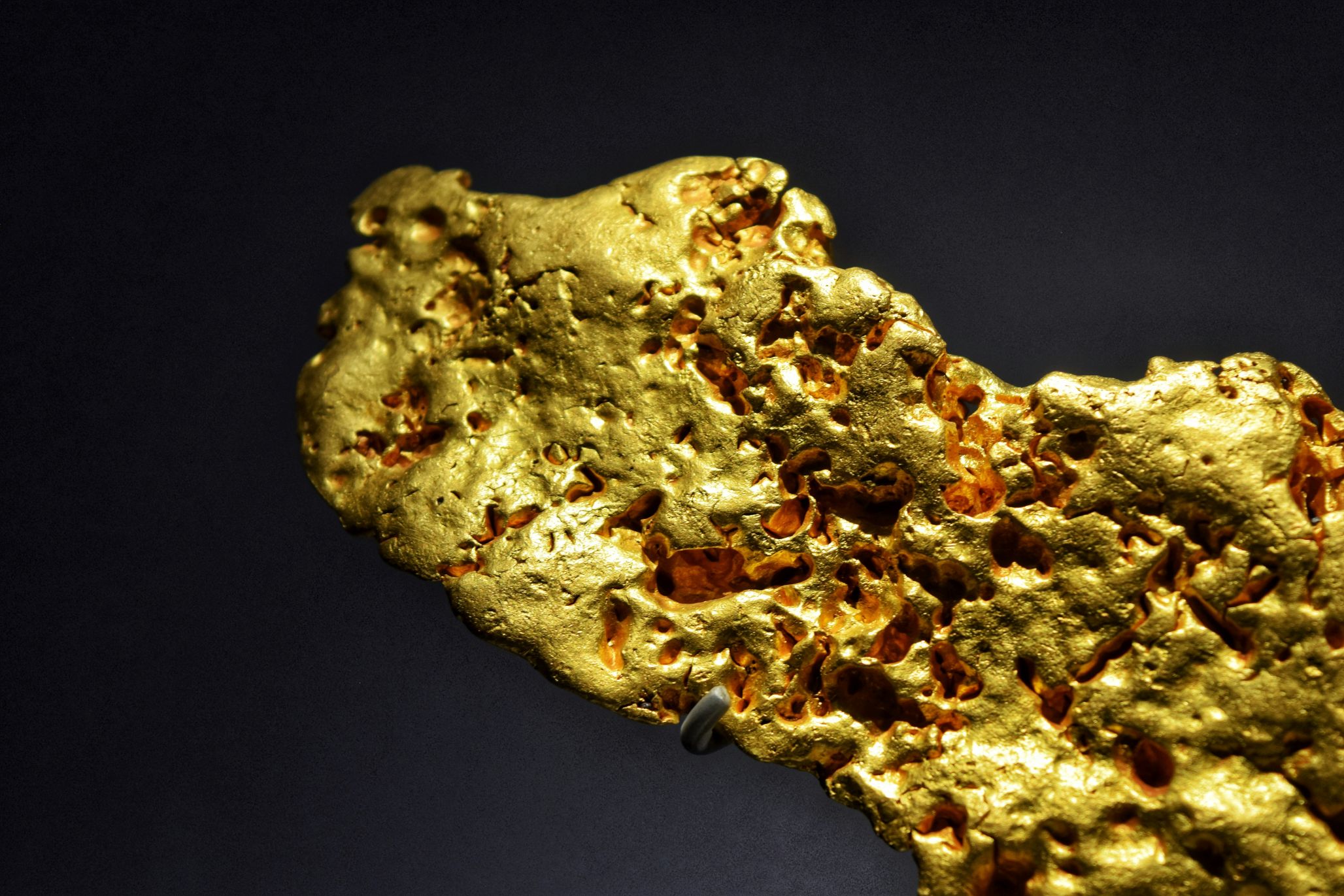

Gold Surges Above $3,800 — Which Miners Are Best Positioned for Growth?

As gold prices soar past $3,800 per ounce, investors are increasingly turning to gold mining stocks for leveraged exposure to the precious metal. Despite this rally, many miners remain undervalued relative to gold itself — creating a prime opportunity for portfolio growth.

With macroeconomic uncertainties such as inflation, central bank diversification, and geopolitical tensions continuing to support gold prices, now may be the ideal time to consider strategic positions in top-performing gold miners.

Why Invest in Gold Mining Stocks?

Gold miners often outperform physical gold in a bull market due to the nature of their business models. As gold prices rise, profit margins widen significantly, leading to stronger cash flow and investor returns.

Additionally:

Here are five of the best-positioned gold mining stocks to consider in 2025.

1. Newmont Corporation – The Blue-Chip Standard

Newmont (NYSE:NEM) is the largest global gold producer and the only gold miner in the S&P 500. With low-cost production, a robust balance sheet, and a 1.3% dividend yield, Newmont offers a lower-risk entry into the sector.

Analyst outlook: UBS predicts a 20–30% increase in share price over the next year as high gold prices persist.

2. Barrick Mining – Global Growth and Resilience

Barrick Mining (NYSE:B) has restructured around high-yield, long-life mines. With low all-in sustaining costs and a 1.8% dividend yield, it’s an efficient operator well-suited for volatile markets.

Analyst insight: Jefferies has set a price target of $40–$44, representing a 25–37% potential upside.

3. Agnico Eagle Mines – Low-Risk, High-Quality

Agnico Eagle (NYSE:AEM) is known for its stable operations in geopolitically secure countries like Canada, Finland, and Mexico. The company operates debt-free, has strong liquidity, and offers a ~1% dividend yield.

Growth outlook: Recent upgrades from UBS and Jefferies reflect confidence in its management and long-term potential.

4. Kinross Gold – The Undervalued Opportunity

Kinross Gold (NYSE:KGC) is a value investor’s pick, with 2 million ounces produced at an AISC of $1,300. Strong cash flows and disciplined cost controls make it a top mid-tier choice.

Future growth: Analysts anticipate 9–10% earnings growth in 2026.

5. Franco-Nevada Corporation – Royalty Exposure Without Mining Risks

Franco-Nevada (NYSE:FNV) offers exposure through royalties and streaming, avoiding the high operational costs of traditional miners. Its high margins and dividend growth (17 consecutive years) make it a standout.

Investor appeal: A defensive, high-margin model that still benefits from gold’s rally.

Final Thoughts

These five companies provide strong fundamentals, growth potential, and various levels of risk exposure to suit different investor profiles. Whether you're seeking stability, value, or aggressive growth, this basket of gold mining stocks offers a strategic way to capitalise on continued momentum in the gold market.

In summary:

Investors should keep an eye on gold price volatility, geopolitical shifts, and central bank policy — all of which could further elevate the appeal of gold-related equities in the months ahead.

Sources: (InvestingPro.com)